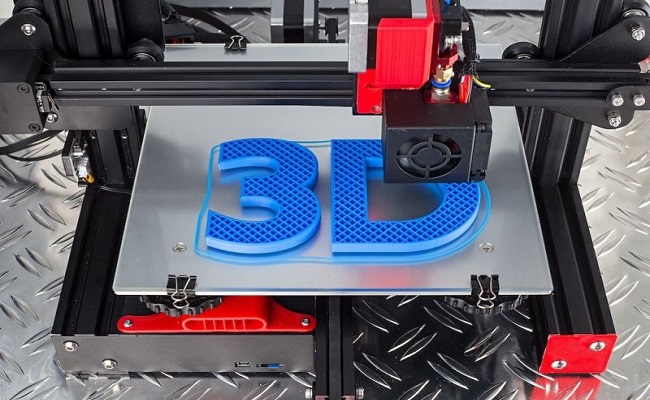

5starsstocks.com 3D Printing Stocks – Exploring the Future of Investment

Introduction to 3D Printing in the Stock Market

Over the past decade, 3D printing has moved from a futuristic concept to a practical technology used in industries like healthcare, automotive, aerospace, and consumer goods. This shift has sparked growing interest among investors who see its potential to reshape manufacturing and distribution.

When combined with a well-researched investment platform like 5starsstocks.com, 3D printing stocks can offer a unique pathway to potentially high returns. But before diving in, it’s essential to understand why these stocks stand out and how they differ from traditional manufacturing investments.

Why 3D Printing Stocks Are Different

Unlike traditional manufacturing companies, businesses in the 3D printing sector often rely on innovation rather than sheer production capacity. This creates an environment where growth can be rapid but also requires careful analysis.

Investors are drawn to 3D printing stocks because:

- Customization is in demand – Products can be tailored to individual needs without increasing production costs significantly.

- Reduced waste – Additive manufacturing uses only the necessary material, appealing to environmentally conscious buyers.

- Speed to market – Concepts can move from design to production in days rather than months.

These qualities set 3D printing apart and explain why many see it as a promising frontier in manufacturing technology.

The Role of 5starsstocks.com in 3D Printing Investments

5starsstocks.com is a resource designed for individuals who want insights into niche investment opportunities. When it comes to 3D printing stocks, the platform offers market data, analytical tools, and trend evaluations that can help investors make informed decisions.

Its approach to covering 3D printing stocks includes:

- Tracking market leaders and innovative startups.

- Analyzing quarterly earnings for growth signals.

- Evaluating global adoption trends of additive manufacturing technology.

By compiling this information, 5starsstocks.com helps investors identify which companies are leading the charge and which are simply following the trend.

What Makes Investment in 3D Printing Stocks a Promising Venture?

Several factors contribute to the appeal of 3D printing investments:

1. Expanding Industrial Applications

From creating airplane parts to producing dental implants, 3D printing is breaking boundaries in multiple sectors. This wide range of applications means the demand for innovative 3D solutions is likely to grow steadily.

2. Strong R&D Focus

Companies in the 3D printing space spend heavily on research and development. This constant innovation can result in breakthrough products, patents, and processes, potentially driving up stock valuations.

3. Supply Chain Transformation

The recent global disruptions have highlighted vulnerabilities in traditional supply chains. 3D printing offers decentralized production capabilities, reducing dependence on large manufacturing hubs and long shipping times.

4. Niche Dominance

Some companies don’t aim to dominate the entire 3D printing market but instead focus on specialized areas, such as medical prosthetics or aerospace components. This specialization can lead to strong market positions and consistent revenue streams.

5starsstocks.com 3D Printing Stocks – A Closer Look

When reviewing opportunities, 5starsstocks.com considers factors beyond simple price movements. Their evaluation framework for 3D printing stocks includes:

- Technology leadership – Is the company ahead in patents and design innovations?

- Market partnerships – Does the company collaborate with large manufacturers or government entities?

- Financial stability – Can the business sustain R&D without excessive debt?

- Scalability – Is the company capable of mass-producing its solutions if demand spikes?

By applying these criteria, investors can identify businesses with genuine long-term potential rather than short-lived hype.

Risks Associated with 3D Printing Stocks

Like any investment, 3D printing stocks come with risks. Understanding them is critical before committing capital.

Market Volatility

Because many 3D printing companies are relatively young, their stock prices can fluctuate significantly based on quarterly results, product announcements, or even general market sentiment.

High Competition

While the technology is innovative, it’s also attracting new entrants every year. Staying ahead requires continuous innovation and marketing strategies that stand out.

Regulatory Hurdles

Industries like healthcare and aerospace require strict compliance with regulations. Companies must invest time and resources to meet these standards, potentially slowing their market entry.

Technology Obsolescence

Rapid advancements in materials and manufacturing methods mean that today’s leading technology could become outdated quickly. Companies that fail to adapt risk losing market share.

Strategies for Investing in 3D Printing Stocks through 5starsstocks.com

Diversify Within the Sector

Instead of investing in just one company, consider spreading investments across multiple businesses. This can balance the risk between established leaders and promising newcomers.

Monitor Industry Trends

Keep an eye on developments like new material capabilities, software upgrades, and government adoption of additive manufacturing. These can signal growth opportunities.

Focus on Long-Term Potential

While short-term gains can be tempting, the real potential of 3D printing may unfold over years as technology becomes more mainstream.

Use Data-Driven Tools

5starsstocks.com offers analytics that track market momentum, company performance, and sector health. Leveraging these tools can help investors avoid emotional decision-making.

Future Outlook for 3D Printing Stocks

As industries become more aware of the benefits of additive manufacturing, adoption is likely to increase. In the coming years, we may see:

- Integration with AI – Smarter machines capable of self-optimizing designs.

- New materials – Expansion beyond plastics and metals to include advanced composites and bio-materials.

- Lower production costs – Making 3D printing more competitive with traditional methods.

If these trends materialize, investors who enter the market early could see substantial returns.

Final Thoughts

Investing in 5starsstocks.com 3D printing stocks offers a blend of technological innovation and market potential that’s rare in the investment world. While the sector carries certain risks, the combination of expanding applications, strong R&D, and shifting global supply chain dynamics makes it an attractive option for forward-thinking investors.

By using platforms like 5starsstocks.com, investors gain access to insights that can help them navigate this evolving market with confidence. The key lies in thorough research, patience, and a willingness to adapt as the technology advances.